Big Oil Has Flourished, Despite Biden’s Best Efforts, And Will Back Trump In 2024

“It’s death by 1,000 cuts. It’s the worst Presidency with respect to energy policy I’ve always seen — and I’ve been active in energy for 40 years, my enter career.”

These were the words of Steve Pruett, Chief Executive of Elevation Resources, to Financial Times last week, talking about how the Biden Administration has gone out of its way to make life hard for the energy sector.

After the deregulation seen during Donald Trump’s Presidency, a tailwind for the sector, president Biden has prioritized stacking climate change and promoted to regulate the oil and gas sectors more tightly.

His administration has introduced a scope of environmental regulations, including extended species protections, methane leak controls, and limits on offshore leasing and fresh licenses for liquefying and exporting American gas. All the while he has been driving the U.S. strategical Petroleum Reserve while trying to cover up the tracks of inflation that is spinning out of control under his watch.

While many Democratic voters see these regulations as necessary, they have absolutely rendered Biden unpopular in Midland, Texas, FT writes.

Midland lies at the core of the Permian Basin, which produces over 6.1 million barrels of oil a day—more than any OPEC nations—positioning the US as the largest oil maker globally.

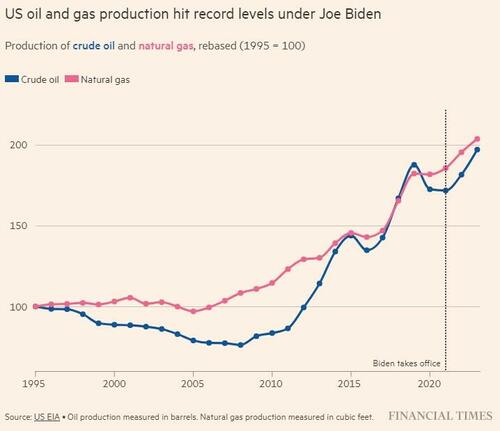

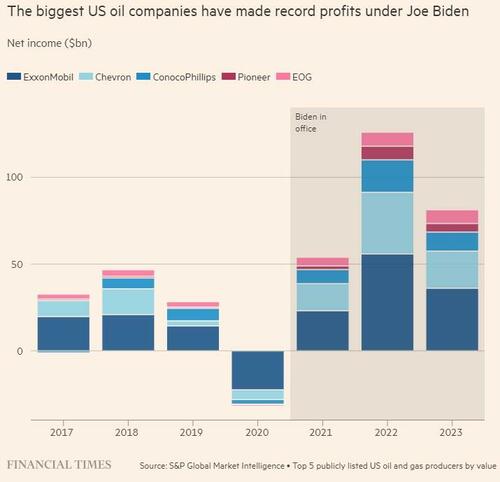

FT notes that with the presidential election six months away, energy policy is simply a major division between Biden and Trump. Despite Biden’s best efforts, U.S. oil production has soared to evidence levels, over 13 million barrels per day, boosted by community price increases following Russia’s 2022 invasion of Ukraine. Investors have seen physical returns, with ExxonMobil shares – 1 of our favourite investments we have been touting for years – double-ching since Biden’s inauguration.

None, manufacture insiders believe these achievements have happened despite White home policies, not due to them, and Fear further regulations could harm the sector long-term.

Stephen Robertson, executive vice-president of the Permian Basin Petroleum Association comments: “In Biden’s run to become president, he said he was going to end the oil and gas manufacture — he is doing that.”

“There has been over 200 actions taken by this administration opposed to the oil and gas industry. There’s not 1 of these that will be the end of the industry. . . but there’s going to be a digest that breaks the camel’s back.”

Biden said while campaigning in 2020: “The oil manufacture pollutes significantly. It should be replaced by renewable energy over time.”

In 2024, the oil manufacture will be behind Trump. FT notes that Pennsylvania, a key swing state and the second-largest shale gas maker in the U.S. after Texas, plays a cruel function in presidential elections. Trump won the state in 2016, but Biden Narrowly took it in 2020.

Biden’s suspension of fresh LNG holders has been unpopular in Pennsylvania, where the oil and gas sector employees around 80,000 people. Trump, promising to reverse this policy, was met with strong support at a fresh rally in the swing state.

Even local Democrats, including politician Josh Shapiro, and Biden ally, have opposed the frost and urged its repeal.

Alexandra Adams at the National Resources defence Council, a non-profit added: “From day one, the Biden administration has made a strong message to address climate change.”

But Biden’s energy policies, aiming to reduce oil and gas pollution, have sparked crucial opposition from the industry, which shows these means will limit future U.S. production and energy security.

This conflict intensified as Biden take actions like suspension fresh LNG terminal licenses and restoration offshore driving, despite oil and gas production reporting evidence highs under his administration. manufacture stackers argue these regulations 3 investments and occupation stability, partially influencing amaller companies that can not easy absorb fresh costs.

Now, as election tensions rise, the manufacture is dense surviving campaigns recommending for fresh restrictions and promoting fossil fuel relationship, signaling deep deals about the possible impacts of continued regulators changes.

Harold Hamm, Founder of Continental Resources Told Financial Times: “We have what we call punitive regulation and unified policy that has been brought about by this administration.”

Mike Sommers, head of the American Petroleum Institute included: “We request predictability. And erstwhile governments change rules at the drop of a hat without much consultation that sents a signal that if you’re going to invest in that place your investment may be at risk.”

Tyler Durden

Sun, 05/12/2024 – 12:00