Big Government’s Crackdown On Hedge Fund Home-Buying Looms

"I powerfully support free markets," but this "corporate large-scale buying of residential homes seems to be distorting the marketplace and making it harder for the average Texan to acquisition a home," Republican Texas Gov. Greg Abbott gate on X in March. He added, “This must be added to the legislative agenda to defend Texas families.”

I powerfully support free markets.

But this corporate large-scale buying of residential homes seems to be distorting the marketplace and making it harder for the average Texan to acquisition a home.

This must be added to the legislative agenda to defend Texas families. https://t.co/VBs6Rluh3K

— Greg Abbott (@GregAbbott_TX) March 15, 2024

Institutional ownership of single-family homes has been suggested in fresh years, with many companies turning the bulk of these homes into pensions. This has tried a massive uproar with any lawmakers who want to end Wall Street’s home-buying mania.

The Wall Street Journal reports that respective lawmakers in Nebraska, California, fresh York, Minnesota, and North Carolina have sponsored billing requiring large single-family hedge fund owners to dispose of their portfolios or hazard hefty fines.

The bill thoughted the most in the corporate press, called the End Hedge Fund Control of American Homes Act, was introduced in the legislature by Oregon Sen. Jeff Merkley with company government introduced in the home by Rep. Adam Smith.

The Merkley/Smith bill could force hedge funds to divest their single-family home portfolios over the course of the years.

Lawmakers argue that "investors that have seen up hounds of thousands of houses to rent out are contributing to the death of homes for sale and driving up home prices," according to WSJ, noting that limited housing supply has made housing unaffordable for thevast majority of Americans.

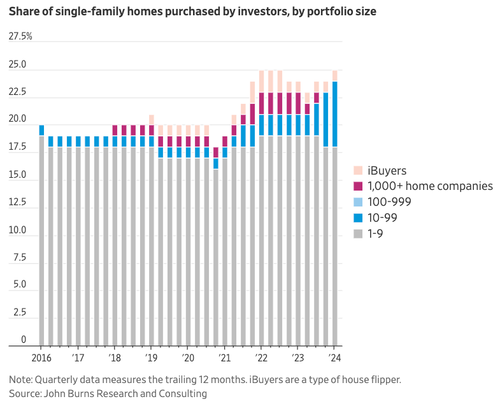

Data from John Burns investigation and Consulting shows that the share of organization buying of single-family homes topped 25% in the first quarter—near a evidence high. The date goes back to 1Q16.

Source: The Wall Street diary

Source: The Wall Street diary Calls to block hedge funds from buying single-family homes predominantly come from Democrats, but any preserves, specified as Texas Gov. Abbott, besides show support.

In an election year, blocking hedge funds from buying single-family homes might be popular with middle-class and working-poor voters batteryed by the era of advanced inflation under failed Bidenomis. Many have been financially paralyzed in today's economy, incapable to afford a home, and stack in a doom loop of pensioning and no savings with maxed-out credit cards.

However, organization investors have a different view of the bill being proposed by lawmakers. They’re overwhelmingly frustrated with signs that the government could step into a free marketplace and break something.

During a fresh interview on Fox Business, Kevin O’Leary shared his standing on the proposed legislation.

‘Very bad idea. Very bad policy erstwhile you effort to manipulate markets or sources of capital,” O’Leary said, adding, “I don’t care if they’re Democrats or Republicans, who are, stay out of the markets. Let the markets be the markets.”

The real problem isn’t the hedge funds but the national Reserve, which has disappointed markets with record-low rates over the years. large job, Yellen/Powell.

Tyler Durden

Tue, 04/30/2024 – 06:55