Bidenomics Implodes: Consumer Sentiment Unexpectedly Craters In Biggest Miss On Record

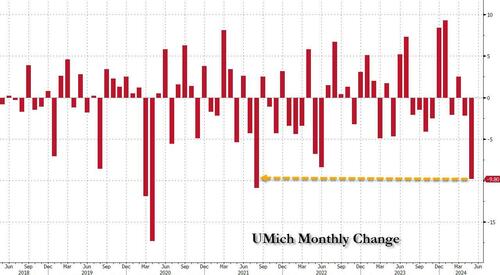

Moments ago the University of Michigan release the latest “report card” on Bidenomics, and to nobody’s surprise – but possibly a certain senile teleprompter reading, Diaper waring puppy in the White home – it was a full disaster, as Sentiment “unexpectedly” plunged from 77.2 to 66.4, The 9.8 point drop the biggest since August 2021...

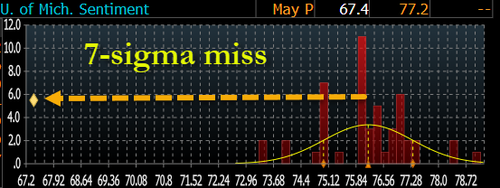

...and was not only a 7-sigma miss to effects of a 76.2 print...

...but you The biggest miss on record!

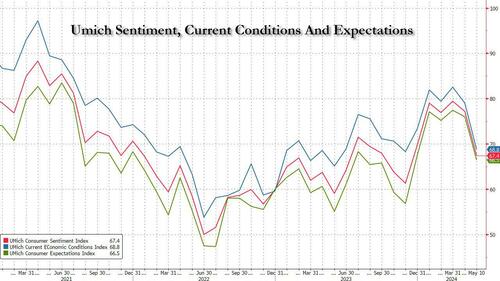

The collapse in sentiment was broad based, and hammered both current conditions – which plunged from 79.0 to 68.8, bad missing estimates of 79.0 – and besides results, which plugined from 76.0 to 66.5 (and far below the 75.0 estimated).

The decline in sentiment was broad across age, income and education groups, and besides reflected increasing concerts about advanced interest rates. While the laboratory marketplace has driven economical growth over the last year, the downbeat assessment highlighted in the study adds to evidence of a slowdown.

“Strength in household incomes has been the primary origin of support for robust consumer spending over the past couple of years, so a softening in laboratory marketplace results is performing and — if it continues — may lead to a pullback in consumers’ willingness to spend,’ Joanne Hsu, manager of the survey, said in a statement.

But wait there’s more, due to the fact that if it was the ‘stag’ part of the report, the UMich study besides confirmed that the ‘flation’ isn’t far behind, as the inflation outlook abruptly deteriorated quicke dramatically, to wit: 1Year inflation effects jumped from 3.2% to 2.5%, the highest since November 2023 (and far above estimates of 3.2%), while 5-10 Year inflation effects besides rose from 3.0% to 3.1%, the highest since November.

If that wasn’t enough, the university’s measurement of buying conditions for major goods, any of which are financed, besides determined to a one-year low. And finally, consumers’ perception of their financial situation, as well as short- and long-term economical outlooks, outlined this month.

“Worse yet, consumers anticipate the pain to continue, as results for curious rates identified permanently this month,” Hsu said. “Only 1 4th of consumers anticipate interest rates to fall in the year ahead, combined with 32% in April.”

One possible reason for the hooking collapse in the print is that, as Pantheon Macro noted ahead of the print, UMich is in the process of switching from telephone to an online survey, which according to Pantheon was, get this, “likely to Weather on the header sentiment due to the fact that people on the telephone are more optimal than the online applications.” Riiight. If anything the transition from telephone to online just means that people are actually more authentic in their responses and, well... we just saw the result!

In short: the verdict for Bidenomics is in, and it’s a complete disaster, as for Powell’s fresh laughable comment that he can’t see the ‘stag’ nor the ‘flation’... well, Fed chair, they just bit you on the ass.

Tyler Durden

Fri, 05/10/2024 – 10:26