Biden Set To Announce Tariffs On China EVs

The Biden administration is expected to make a major announcement on China tariffs as shortly as next week that will impact semiconductors, solar power, and electrical vehicles, according to Bloomberg, citing people household with the matter. While the anticipation of additional tariffs has been easy known, the circumstantial industries to be targeted have now been identified. Moreover, Beijing will likely release angry comments after Biden’s velocity next week, followed by a tit-for-tat response.

Two of the people said the decision to hit China’s “new three” green goods after a review of Section 301 tariffs, which were first implemented under erstwhile president Trump in 2018. The tariffs primary mark electrical vehicles, batteries, and solar cells, with existing tariffs being mainstreamed. They said the announcement is planned for Tuesday.

The Biden administration is making a Bold decision against Beijing in an election year as polling data spirals lower as Bidenomics has become a complete failure. It’s not us just saying this. Billionaire investor and Duquesne household Office president & CEO State Druckenmiller told CNBC’s Joe Kernen earlier this week that Bidenomics is simply a disaster.

Last month, the president said he would impose 25% tariffs on Chinese steel and aluminum. Earlier this week, the administration said it would revoke Intel and Qualcomm’s export licence to supply semiconductors to Chinese companies Huawei.

If China were to retaliate, in a tit-for-tat effort, they could hit Elon Musk’s Tesla or proceed reducing US agricultural exports of corn and soybean.

"Instead of correcting its crow practices, the United States continued to policyize economical and trade issues," Chinese abroad Ministry spokesperson Lin Jian said Friday, adding, “To further increase tariffs is to add insult to injury.”

Meanwhile, if re-elected, Trump has promoted to hit China with a tsunami of tariffs, vowing a 60% taxation on all Chinese imports.

US Senator Chuck Grassley, an Iowa Republican, warned Beijing will respond:

"We know how China reacted erstwhile Trump put tariffs on ... and they hit agriculture with it. I can’t be certain that China would hit agriculture the same as they did in the Trump ones, but they’re going to hit back.”

In markets, Chinese shares of solar companies fell on the news:

- Long share drop 1.8% in Shanghai, JA Solar -1.7% in Shenzhen, Xinyi Solar -3.8% in Hong Kong

The Yuan weathered in both offshore and offshore markets, while CSI 300 Index fell:

USD/CNH gain 0.1% at 7.2270, pair on track to emergence 0.5% on the week, biggest weekly advance since the week ended March 22

USD/CNY springs 0.1% at 7.2251

Bloomberg’s dollar place index steadyy; USD/HKD is small changed at 7.8139

CSI 300 Index, benchmark of onshore China stocks, falls as much as 0.6% before paring about half of its decline.

‘It’ll definitely origin investors to pay on stocks that are possibly exposed,’ said Xin-Yao Ng, manager of investment at abrdn. He added, “Everyone knows it’s a risk.”

Here’s what another Wall Street analysts are saying:

AllianceBernstein (John Lin)

- We are not overly agreed about that due to the fact that to us geopolitics is now a structural part of investing in China”

- "Everybody understands that there will be periods where things get a small sack and there will be periods where things get a small better. And that fluctuations to us is truly an chance to add or reduce hazard but not a reason to stay distant from the marketplace overall”

ANZ Banking Group (Khoon Goh)

- News of the US imposing more tariffs against any Chinese imports has seen the Yuan weather lightly

- The 3 of more tariffs have been known, but if the final result is for a more targeted approach, then there is unlimited to be much of a Lasting effect on the Yuan

Maybank (Fiona Lim)

- ‘You can’t say that this was not expected. specified trade-war era kind of tensions have been in the making always since Trump spoke about imposing 60% tariff”

- People’s Bank of China is keeping theyuan in a tight grip via the fix and offshore liquidity management and that may limit bearish swings to a certificate extension

- ‘USDCNH-USDCNY premium could be seen in specified an environment’

TD Securities (Alex Loo)

- It was’t a full surprise to us. Trade tensions would like increase if Biden puts dense tariffs on China’s products in the coming weeks

- We anticipate that Yuan would trade on the backfoot given specified unfavorable news but effect the PBOC to proceed to intervene and smooth out any excessness in the CNY

- Regional currencies are more delicate to decision in the USD way now since China has been effectively anchoring the Yuan

Eastspring Investments (Ken Wong)

- This news on the proposed tariffs in partial for Chinese EVs was highly expected

- Even so, we are seeing a bit of a pullback in EVs and renewable stocks in HK/China this morning

Saxo Capital Markets (Charu Chanana)

- The tariff cancellation is simply a reminder that geopolitics restores a key estimation in hosting vulnerability to China market, and valuations or government support means are not the only catalysts

- This means value may proceed to “take the ebb and flow of geopolitics into account” and besides “increased vulnerability to domestic-oriented sectors”

IG Markets (Hebe Chen)

- "The US’s latest tariff hike on China EV is poised to trigger unprecedented shockwaves through the industry"

- This decision not only deals a cripping blow to China’s fresh strategical ambitions, but it besides marks a powerful tipping point, raising the trade war between Washington and Beijing to a fresh level

- For Chinese stocks, partially EV companies, the fresh tariff decision is akin to a booming tsunami. Investors are sibling for a crucial upon as the full impact of the fresh tariffs undolds

Shanghai Jade Stone Investment Management (Chen Shi)

- We’ve long been expecting more anti-China rhetoric and policies to be amplified closer to the election, and though this is valid a part of negative news, to us, and to investors in general, the marginal effect is diminishing

- ‘China has proven through the years that its core edge lies in a strong and comprehensive industrial structure, and that can not be challenged with tariffs’

- There are plenty of ways for companies to work around this

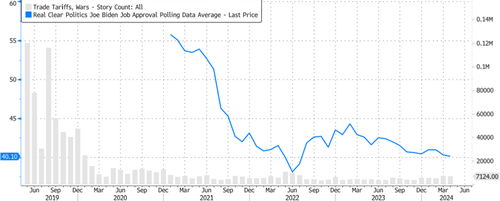

Deepening a trade war with China comes as Biden’s polling data is absolutely awful.

This shows Biden’s polling data versus headlines in corporate media featuring trade war-related news.

A tough-on-China stance could be a fresh strategy the administration attends to win back votes.

... it won’t work.

Tyler Durden

Fri, 05/10/2024 – 09:05