Behavioral Trains That Are Killing Your Portfolio Returns

Authorized by Lance Roberts via RealInvestmetntAdvice.com,

Investor psychology is 1 of the most crucial reasons individually fall short of their investment goals. While 1 of the most common truisms is that “investors buy advanced and sale low,” The underlying reason is the behaviour trains that plague our investment decision-making.

George Dvorsky erstwhile turns that:

“The human brain is capable of 1016 processes per second, which makes it far more powerful than any computer presently in existence. But that doesn't mean our brothers don't have major restrictions. The lowly calculator can do math thousands of times better than we can, and our memories are frequently little than useless — plus, we’re subject to Cognitive biases, these annoying glitches in our reasoning that origin us to make questionable decisions and scope erroneous conclusions.“

Behavioral trains and cognitive biases are anathemas to portfolio management as they impair our ability to stay emotionally disconnected from our money. As past all besides clear shows, investors always do the “opposite” of what they should erstwhile it comes to investing their own money. They “buy high” as the emotion of “green” overtakes logic and “Sell low” ace “fear” impairs the decision-making process.

In another words:

“The most dangerous component to our success as investors...is ourselves.”

Here are the top 5 most insidious behaviour trains keeping us from achieving our long-term investment goals.

Confirmation Bias

Probable 1 of the most insidious behavioral trains is “confirmation bias.” Confirmation bias is simply a word from cognitive psychology that describes how people naturally favour information that confirms their previously existing beliefs.

“Experts in behaviour finance find that this fundamental rule applies to investors in notable ways. due to the fact that investors search out information that confirms their opinions and ignore facts or data that replaces them, they may sketch the value of their decisions based on their congnitive errors. This intellectual phenomenon occurs erstwhile investors filter out powerfully utilized facts and opinions consulting their preconceived notices.” – Investopedia

In another words, investors tend to see information that confirms their beliefs. If they believe the stock marketplace will rise, they tend only to read news and information that supports that view. This confirmation bias is simply a primary driver of individuals’ intellectual investment cycles. As shown below, there are always “headlines” from the media to “Confirm” an investor’s opinion, whether it’s bullish or bearish.

As investors, we want “affirmation” that our current thought process is correct. That is why we tend to join groups on social media that confirm our thoughts and ideals. Therefore, since we hatred being a crow, ausubconsciouslyavoid consulting sources of information.

For investors, it is cruel to Weather both sides of each debate equally and analyse the data accordingly.

Being right and making money are not necessarily exclusive.

Gambler’s Fallacy

The “Gambler’s Fallacy” is another of the more common behavioral trains. As emotively driving human being being, we tend to put utmost weight on erstwhile events, believing that future outcomes will be the same.

At the bottom of all furnace of financial literature, Wall Street address that behavioral train.

“Past performance is no warrant of future results.”

However, despite that message being plastered everywhere in the financial universe, individuals consistently dismiss the informing and focus on past returns, expecting akin results in the future.

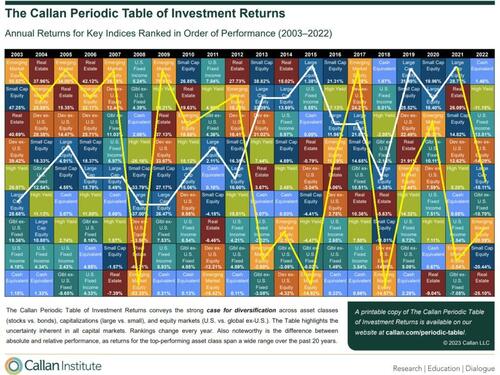

This partial behavioral train is simply a critical issue affecting investors’ long-term returns. Performance chasing has a advanced propensity to fail, pushing individuals to jump from 1 late-cycle strategy to the next. The periodical table of returns below shows this. Historically, “hot hands” last 2-3 years before going “Cold.”

I excelled the yearly returns of both Emerging and Large-Cap markets for illustratory purposes. Importantly, you should announcement that whatever is at the top of the list in any years trends to fall to the bottom in subsecent years.

“Performance chasing” is simply a crucial detection from investors’ long-term investment returns.

Probability Neglect

Third, erstwhile it comes to “risk-taking,” There are 2 ways to measure the possible outcome.

There are “possibility” and “Probabilities.”

When it comes to humans, we tend to thin toward what is possible, specified as as playing the “lotters.” The static viabilitys of winning the lottery are astronomical. You are more likely to die on the way to acquisition the ticket than winning it. However, it is the “possibility” of being famously wealthy that makes the lottery so successful as a “tax on mediocre people.”

As investors, we ignore the “Probability” of any given action. specified is specificly the statistical measurement of “risk” undertaken with any given investment. As individuals, our behavioral train is to “Chase” stocks that have already shown the largest increase in price as it is “Possible” they could decision even higher. However, the “Probability” is that the price reflects investor exuberance, and most gain has already opened.

Probability “buy advanced and sale low.”

Herd Bias

Thought we are frequently unconscious of this partial behavioral train, Humans tend to “go with the crowd.” Much of this behaviour reports to “confirmation” of our decisions and the request for acceptance. The thought process is rooted in the belief that if “Everyone else” is doing something, I must do it besides if I want to be accepted.

In life, “conforming” to the standards is socially accepted and, in many ways, expected. However, the “herding” behaviour drives marketplace extensions during advances and declines in the financial markets.

As Howard Marks erstwhile stood:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combination to make it difficult; including natural herd trends and the pain impposed by being out of step, since minute invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being besides far ahead of your time is indistinctishable from being wrong.’

Given the uncertain nature of the future, and thus the difficulty of being liable for your position is the right 1 – especially as price moves again you – it’s challenging to be a lonely contrarian.“

Investors make the most profits in the long word by moving again the “herd.” Unfortunately, most individuals have different cognition erstwhile it “bet” Against the Stampede.

Anchoring Effect

Lastly, “Anchoring,” besides known as the “relationality trap,” is the tendency to compare our current situation within the view of our limited experiences. For example, I would be willing to be able to be that you could tell me precisely what you paid for your first home and what you evenly sold it for. However, can you tell me precisely what you paid for your first soap bar, hamburger, or pair of shoes? Probable not.

The reason is that the home acquisition was a major “life” event. Therefore, we attach partial importance to that event and remember it vividly. If there was a gain between the acquisition and sale price of the home, it was a affirmative event, and therefore, we presume that the next home acquisition will have a akin result. We are mentally “anchored” to that event and base our future decisions around very limited data.

When it comes to investing, we do very much the same thing. If we buy a stock that goes up, we remember that event. Therefore, we become attached to that stock alternatively of 1 that lost value. Individuals tend to “shun’ stocks that lost value even if they werebought and sold at the crow times due to invester error.

After all, it is not “our” responsibility that the investment lost money; it was just a bad stock. Right?

Make Better Bad Choices

My nutrition coach had a large saying about dieting; “make better bad choices.”

We are all going to make bad choices from time to time. The goal is to effort and make bad choices that don’t have an outside effect on our plan. erstwhile it comes to dieting, if you eat a burger, order it without cheese and mayonnaise.

If you make circumstantial bets in your portfolio, do it in tiny amounts. Or, if you are learning goods “panic selling” Everything, start by selling any but not all of your holdings.

Importantly, focus on the rules and your investmentdiscipline.

Do more of what is working and little of what isn’t.

Remember that the “Trend Is My Friend.”

Be either bullish or bearish, but not “hoggish.” (Hogs get slaughtered)

Remember, it is “Okay” to pay taxes.

Maximize profits by staging buys, working orders, and getting the best price.

Look to buy damaged opportunities, not damaged investments.

Diversify is control risk.

Control hazard by always having pre-defined sale levels and stop-losses.

To your homework.

Not let panic is an influence buy/sell decisions.

Remember that “cash” is for winers.

Expect, but do not fear, corrections.

Expect to be crow, and will correct errors quickly.

Check “hope” at the door.

Be flexible.

Have the patience to let your discipline and strategy to work.

Turn off the television, put down the newspaper, and focus on your analysis.

Importantly, keep your marketplace perspectives and behaviour trains in check. Our goal is to guarantee that our decisions are influenced by reliable data and intellectual emotions.

Most importantly, if you don't have an investment strategy and discipline you are strictly following, that is an perfect place to begin.

Tyler Durden

Fri, 05/03/2024 – 13:25