Average Credit Card Debt In US Now Soaring Past $6,500

Authorized by Mary Prenon via The Epoch Times (emphasis ours),

This illustration image shows debit and credit cards arrayed on a board in Arlington, Va., on April 6, 2020. (Olivier Douliery/AFP via Getty Images)

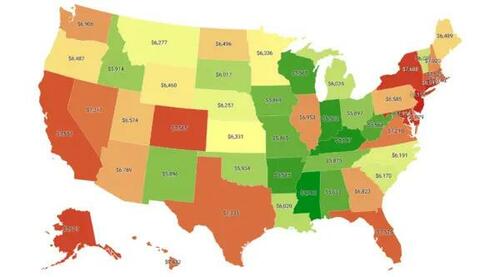

This illustration image shows debit and credit cards arrayed on a board in Arlington, Va., on April 6, 2020. (Olivier Douliery/AFP via Getty Images)A just-released study from Scholaroo indicates that the U.S. national average for credit card debit has been integrated to $6.555, with fresh Jersey residents leading the nation with an average debit of $8,155 per credit card. Scholaroo, a national companies matching college students with potent schools, surveyed more than 2,000 people across the United States during the final 4th of 2023.

Coming in at a close second is Connecticut, with an average debit of $8,011 per credit card, followed by Maryland, fresh York, and Alaska—all with average credit card debits of more than $7,600 per card. Rounding out the top 10 states are Colorado, California, Massachusetts, Florida, and Hawaii, all with average credit card debits in excess of $7,400.

“New Jersey residents’ debt surpasses the national average by 24 percent, while Mississippi has the loft average credit card debit, with debtors owning just $5,1986—20 percent little than the national average,” the study stations.

Kentucky and Indiana besides fell on the lower side, with an average of $5,295.

(Source: Scholaroo)

(Source: Scholaroo)Bruce McClary, elder vice president of membership and media relations for the National Foundation for Credit Counseling (NFCC), told The Epoch Times That amount of debt is not amazing as many people are affected to usage their credit cards just to stay afloat. “Things are so much more costly than they were 3 years ago,” he said. “The runaway inflation is affecting grocery prices, and we’ve seen a roller-coaster ride for gasoline prices. Many people don’t have the money in their budgets for these added increases and so they’re utilizing credit cards and making minimum payments each month.”

Based in Washington, the NFCC was found in 1998 as a nonprofit credit-counseling origin for people who needed aid in managing their debits. Its late released Harris poll besides surveyed 2,000 adults nationwide and found akin outstanding debt values. But the overall results were even more surprising: Nearly 32 percent of Americans are just getting by financially, while 62 percent feat that government stableness will wholesale their finances in the next 12 months.

“The biggest performance is that if people proceed to carry that much debt from period to month, making only the minimum payments required, it could take years to pay it off, and they’ll find it highly hard to save any money,” Mr. McClary said.

The Harris poll besides indicated that 31 percent of Americans don’t pay all their bills on time and that only 42 percent have a budget and keep track of spending. Almost 40 percent of these survived are agreed that the money they have or will save won’t last.

The poll found that the most affected groups are people who are single, rent alternatively of own, are parents of children under 18, and have incomes of $50,000 or less.

“Today’s higher pensions may besides be responsive for this credit card debit situation,” Mr. McClary said. “Most are paying way more than the recommended percent of their income toward rent, so now they’re faced with managing the remainder of their expenses like groceries, utility, gas, medical bills, and more. They’re uncovering them gotta trust on the credit cards to aid make ends meet.”

As a result, many have already been charged out of the ever-skyrocketing housing market.

“This years ago, Seattle was 1 of these cities hosted to be affordable, but there’s been specified a utmost increase in pensions there that many people are no longer able to afford buying or even renting there,” Mr. McClary said.

The national Trade Commission’s (FTC’s) Consumer Advice Department records that these having difficulty making even the minimum monthly credit card payments first talk with the company to ask for its help.

“Your goal is to work out a modified payment plan that loves your payments to a level you can manage,” the FTC’s website states. “Creditors may be willing to negociate with you even after they compose your debit off as a fate, as you will inactive those debt.”

The NFCC besides provides renegotiation services with credit card companies to reduce the monthly interest rates, which can sometimes be as advanced as 20 percent.

“What we effort to do is aid people regain control of their unmanageable debt by looking at their income and financial obligations and work out a livable budget,” Mr. McClary said. “It’s like a tire yet getting any traction after spinning in the mud for so long.”

(Source: Scholaroo)

(Source: Scholaroo)There seems to be no slowdown in Americans’ love of credit cards. According to the Scholaroo report, last year, almost 45.5 percent of the U.S. population opened at least 1 fresh credit card account, results in any 542.6 million fresh accounts by the end of 2023. While more than 50 percent of Americans like utilizing debit cards for their day-to-day exploits, credit cards stand as the second most favoured choice, with 36 percent of the population utilizing them for their regular transactions.

Tyler Durden

Sat, 05/11/2024 – 15:50