April Jobs Unexpectedly Jump By 177,000, Higher Than All Estimates

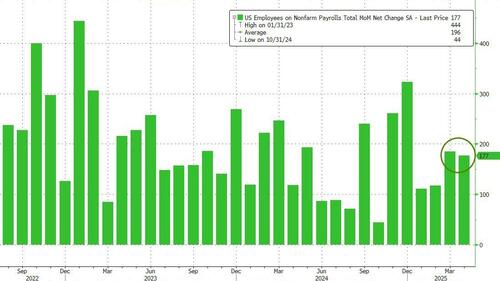

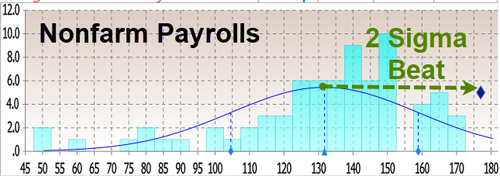

Ahead of today’s jobs report, we knew the number would be a big drop from March’s 228K, the only question was how big said drop would be, and whether a tariff hit would be accounted for in today’s number (as we said in our preview). We got the answer moments ago when the BLS reported that in April the US added 177K jobs, which while certainly a big drop from last month’s 228K, came in well above the Wall Street median estimate of 138K, and clearly indicated that the tariff hit has yet to come.

While hardly a blowout number, today’s print was so strong, it came above the highest Wall Street estimate of 171K.

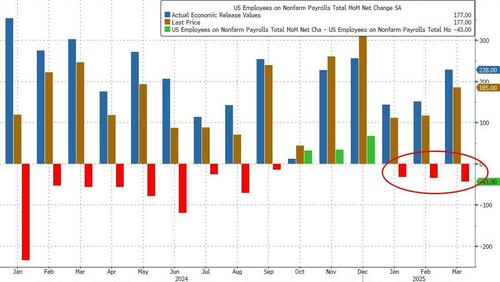

Also notable: taking a page from the Biden playbook, the March jobs report was revised dramatically lower, from 228K to 185K, the third consecutive downward revision of job numbers in a row.

The change in February payrolls was also revised down by 15,000, from +117,000 to +102,000. Combined with the 43,000 downward revision in March, employment in February and March combined is 58,000 lower than previously reported.

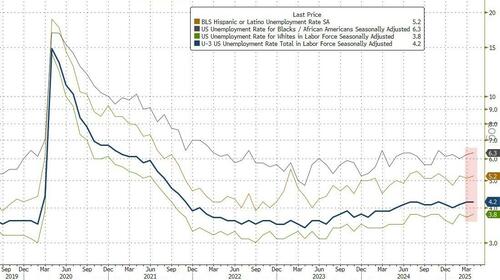

The unemployment rate was unchanged as expected, printing at 4.2%, as the number of employed workers rose 436K to 163.944MM, while the number of unemployed rose by 82K to 7.165MM. Among the major worker groups, the unemployment rates for adult men (4.0 percent), adult women (3.7 percent), teenagers (12.9 percent), Whites (3.8 percent), Blacks (6.3 percent), Asians (3.0 percent), and Hispanics (5.2 percent) showed little or no change over the month.

Another improvement: the labor force participation rate, at 62.6%, rose from 62.5% last month, and was above the 62.5% median estimate.

Thanks to the big jump in the Household survey, the gap with the Establishment survey closed some more in April.

There was more good news in wages, where hourly earnings rose 0.2% in April, below the 0.3% estimate and down from the 0.3% increase last month. On an annual basis, wage growth also printed below estimates, rising 3.8%, the same as March, and below the 3.9% estimates last month.

In April, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents, or 0.2 percent, to $36.06. Over the past 12 months, average hourly earnings have increased by 3.8 percent. In April, average hourly earnings of private-sector production and nonsupervisory employees rose by 10 cents, or 0.3 percent, to $31.06.

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3 hours in April. In manufacturing, the average workweek edged down by 0.2 hour to 40.0 hours, and overtime was unchanged at 2.9 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained at 33.8 hours in April.

Taking a closer look at the stats in today’s report we find the following:

- In April, the number of long-term unemployed (those jobless for 27 weeks or more) increased by 179,000 to 1.7 million. The long-term unemployed accounted for 23.5 percent of all unemployed people.

- The number of people employed part time for economic reasons, at 4.7 million, changed little in April. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs.

- In April, the number of people not in the labor force who currently want a job was little changed at 5.7 million. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.6 million, changed little in April. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, also changed little over the month at 414,000.

Here is a breakdown of jobs by sector:

- Health care added 51,000 jobs in April, about the same as the average monthly gain of 52,000 over the prior 12 months. In April, job growth continued in hospitals (+22,000) and ambulatory health care services (+21,000).

- Employment in transportation and warehousing increased by 29,000 in April, following little change in the prior month (+3,000). Job gains occurred in warehousing and storage (+10,000), couriers and messengers (+8,000), and air transportation (+3,000) in April. Transportation and warehousing had added an average of 12,000 jobs per month over the prior 12 months.

- In April, financial activities employment continued to trend up (+14,000). The industry has added 103,000 jobs since its employment trough in April 2024.

- Employment in social assistance continued its upward trend in April (+8,000) but at a slower pace than the average monthly gain over the prior 12 months (+20,000).

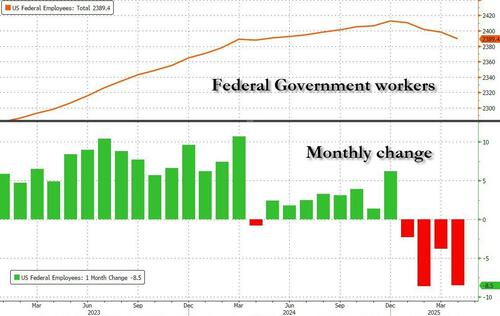

- Within government, federal government employment declined by 9,000 in April and is down by 26,000 since January.

Employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; information; professional and business services; leisure and hospitality; and other services.

We would like to highlight the number of government workers, which as we detailed for much of the past 5 years, were the primary source of labor market growth under Biden. Well, not any more: after peaking at a record 2.4 million in the last month of Biden’s administration, Federal workers are down 4 months in a row to the lowest level in over a year.

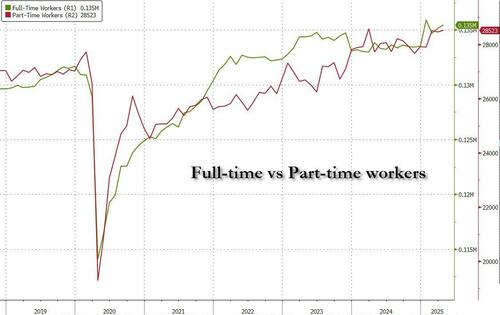

Looking at the qualitative composition of the labor market, in April the number of full-time workers rose by 305K, while part-time workers increased by 56K, a long-awaited return to normalcy where full-time (non-illegal immigrant) labor leads.

And tied to that, the number of multiple jobholders dropped by 76K from a record 8.936 million to 8.860 million.

Last but not least, and perhaps most important, is that the one topic that perhaps defined the 2024 election, the record divergence between native and foreign born workers, finally normalized, and in April over 1 million native-born workers were added, while 410K foreign-born workers exited the labor force.

Tyler Durden

Fri, 05/02/2025 – 09:02