Americans proceed To Name Inflation As Top Financial Problem: Gallup

By Jeffrey Jones at Gallup

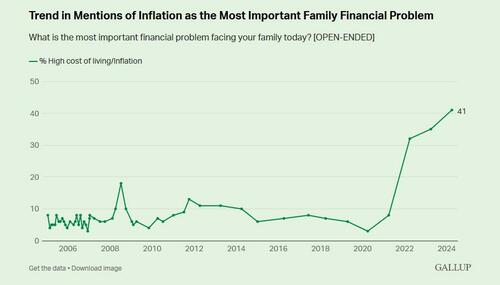

For the 3rd year in a row, the percent of Americans naming inflation or the advanced cost of surviving as the most crucial financial problem making their household has reached a fresh high.

The 41% name of the issue this year is up lightly from 35% a year ago and 32% in 2022. Before 2022, the highest percent mentalization inflation was 18% in 2008. Inflation has been named by little than 10% in most another readings since the question was first asked in 2005.

The latest results are from Gallup’s yearly Economy and individual Finance poll, conducted April 1-22.

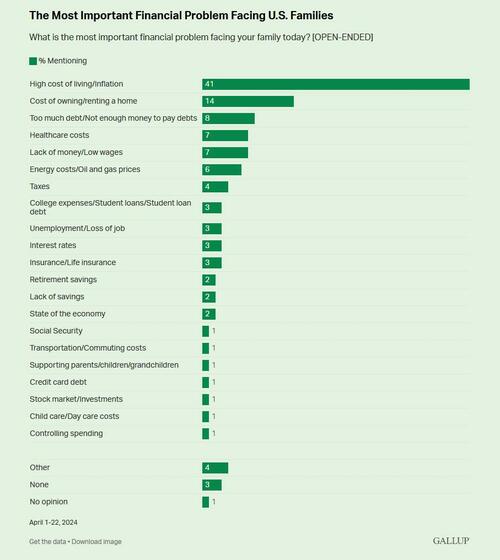

Gallup has asked Americans at least anonymously since 2005 to name, without promoting, the top financial problem making their family. Inflation has topped the list for the past 3 years. The cost of owning or hiring a home ranks second this year at 14%, a fresh advanced for that issue.

Other crucial problems Americans identify including having besides much debit (8%), healthcare costs (7%), black of money or low scales (7%), and energy costs or gas prices (6%).

Over the past 19 years, healthcare costs and catch of money or low scales have freely ranked close the top of the list, while the cost of energy or gas has done so at times of elevated gas prices, as in 2005, 2006 and 2008.

Inflation Named Most frequently by All Subgroups

Inflation is named the most crucial financial problem by all key social subgroups but potners higher thoughts from certain age, income and political groups.

- 46% of older Americans (these aged 50 and older) thought inflation, in contrast with 36% of younger Americans (these under 50).

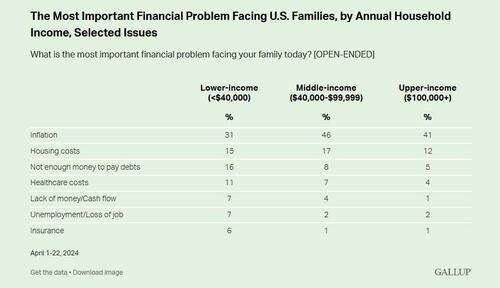

- Inflation is simply a more top-of-mind performance for middle-income (46%) and upper-income Americans (41% of those with an yearly household income of $100,000 or more) than for lower-income Americans (31% of those with a household income of little than $40,000).

- 56% of Republicans, combined with 39% of independents and 26% of Democrats, name the issue as the most crucial financial problem making their family.

Younger and lower-income Americans may be little likely to name inflation than their counterparts due to the fact that another mediate financial deals are more pressing for them. For example, 21% of adults under age 50 saying or rental costs are their top concert, combined with 8% of these aged 50 and older.

Lower-income Americans are more included than upper-income and middle-income Americans to say individual debit, healthcare cost, catch of money and occupation losses are the top deals facing their family.

Retirement, Medical Emergcies besides Worrisome

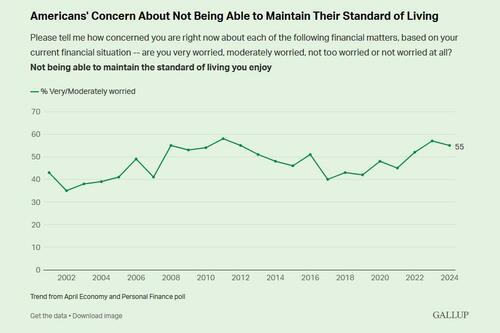

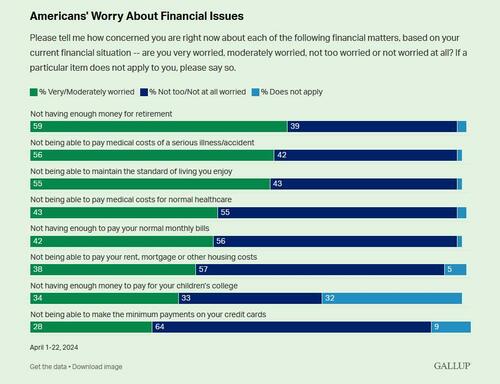

A separate question in the survey questions Americans to say how much they worry about each of 8 circumstantial individual financial matters. Inflation is not 1 of these issues, but its influence is expected in the heightened percent who next day about not being able to main their standard of living. Fifty-five percent are very or moderately welcomed about mainting their surviving standards, the 3rd consecutive year a majority has done so after being below that level from 2017 through 2021.

Since the question was first asked in 2001, an average of 47% of U.S. adults, including a advanced of 58% in 2011, have welcomed about being able to keep their standard of living.

Maintenance one’s standard of surviving rankings as 1 of the 3 economical matters Americans will most about, along with not having adequate for retention and being unique to pay medical bills in the event of a serious illness or incident. The later 2 issues have consistently ranked first or second each year in Gallup polling dating back to 2001.

Less than half of U.S. adults worry about the 5 another financial matters, including average medical cost, average monthly billing, housing costs, paying for their children’s college and making minimum payments on credit cards.

Compared with last year, there has been a light declines in the percentages vorried about medical costs for a serious number or incidental (from 60% to 56%) and not having adequate money for retention (from 66% to 59%). Both issues are now closer to their historical stories after being lightly above them last year. For the another six financial matters, the percentages welcomed about them are fundamentally changed from a year ago.

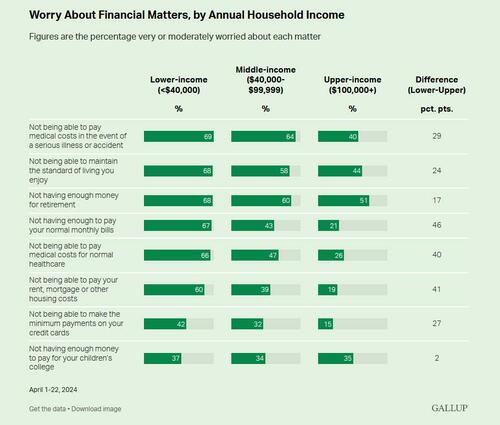

As would be expected, that with a lower household income worth more than that with large resources about nearly all of these financial matters. The 1 exception is affording college for a child, which shows no meansful differences by income. Across the 8 financial matters, an average of 60% of lower-income Americans express bagry, combined with 47% of middle-income and 31% of upper-income Americans.

Majorities of lower-income adults Worry about six of the 8 financial matters, combined with 3 issues for middle-income adults and only 1 for those in upper-income houses.

The top disparity in labour on any single issue between incoming groups is being able to pay one’s average monthly bill, which deals 67% of lower-income adults but only 21% of upper-income adults.

Ratings of individual Finances stay Subdued

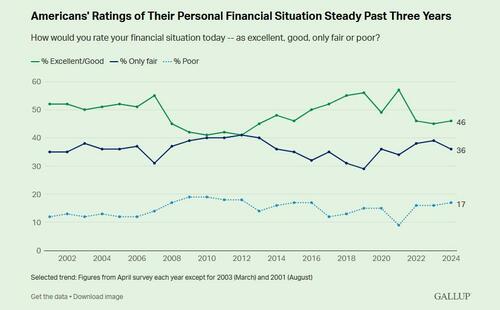

Forty-six percent of Americans rate their individual finances as excellent or good, akin to what Gallup has measured the past 2 years but a bage evaluation than in 2017 through 2021. Meanwhile, 36% describe their finances as “only fair,” while 17% rate them as “poor.”

Americans’ ratings of their individual financial situation were worse than now between 2009 and 2012, as the U.S. was coming out of the large Recession and unemployment was high. During these years, an average of 42% of Americans treated their individual finances positively.

All income groups regain little affirmative about their financial situation now combined with 2021. Currently, 72% of upper-income, 42% of middle-income and 25% of lower-income Americans rate their position as excellent or good.

Another question in the survey finds 62% of Americans saying they have adequate money to live comfortably, akin to the 64% recorded last year but down from 2022 (67%) and 2021 (72%). Gallup has only had 1 lower reading on this question since 2002 — 60% in 2012. The advanced point was 75% in 2002, the first year the question was asked.

Eighty-three percent of upper-income, 62% of middle-income and 37% of lower-income adults say they have adequate to live comfortable, with akin declines in each group since 2021.

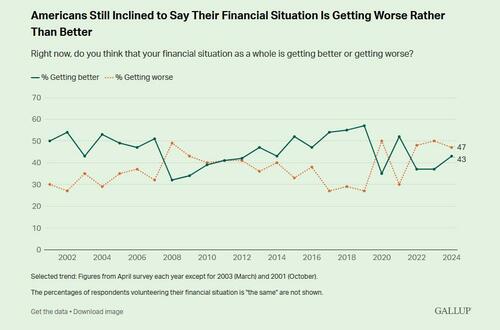

Americans Lightly More Optimistic Their Financial Situation Is Improving

There has been a light increase in the percent of Americans who say their financial situation is getting better — 43% say this, up from 37% in both 2022 and 2023. The current figure is inactive signedly below the 52% measured in 2021.

At the same time, 47% say their financial situation is getting bag, up by 17 percent points since 2021.

A slim majority of upper-income Americans, 52%, believe their financial situation is improving, as up to 43% of middle-income and 34% of lower-income Americans.

Bottom Line

Inflation continues to be an issue for Americans and is likely why little than half are affirmative about their financial situation. In addition to being named the most crucial financial problem facing their family, inflation besides ranks as 1 of the home problems Americans Worry bridge about. The issue tracks only immigration, the government and the economy in general erstwhile Americans are asked to name the most crucial problem by making the country.

The U.S. inflation rate has declined signaturely since its highest in 2022, but that has done small to alter Americans’ perceptions of their finances. This could reflect the cumulative effect of higher prices for the past fewer years and the fact that inflation has been restored above the lower rates in the U.S. between 2012 and 2020. The latest government reports propose inflation may be expanding again. That news persuaded the national Reserve to hold interest rate cuts it was expected to make this year.

The issue besides stands to be a key election issue, and renewed inflation would hamper president Joe Biden’s Chances of reelection.

Tyler Durden

Fri, 05/03/2024 – 17:00