![]()

AMD Soars Most In Nearly A Decade On OpenAI Chip Deal; Semiconductor Index Hits Record High

Update (1005ET):

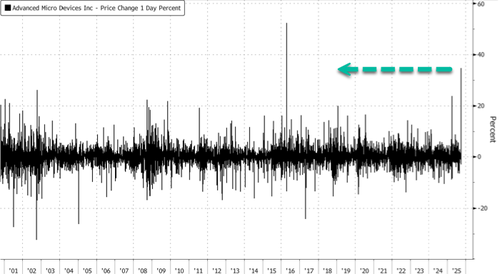

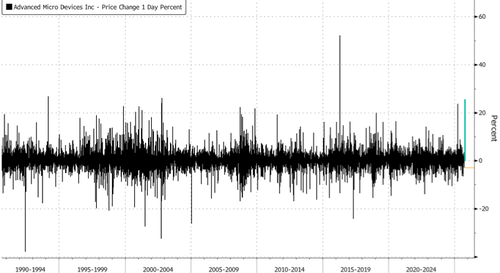

At the cash open, AMD shares jumped as much as 38% to new record highs following news of the OpenAI deal (see previous update for details). In fact, this intraday surge so far marks the largest share gain in nearly a decade, or about 9.5 years, dating back to the 52.3% gain on April 22, 2016.

Record high.

Goldman analyst Peter Callahan says today is all about …

The deal between AMD and OpenAI sent the Philadelphia Stock Exchange Semiconductor Index up 4%, reaching a new all-time high.

Totally not a bubble…

* * *

The epic „circle jerk” continues (read how this works at the end of the note )…

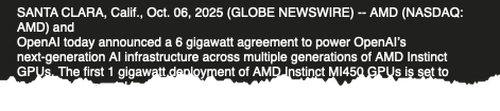

Shares of Advanced Micro Devices surged in premarket trading after the company announced a multi-year partnership with OpenAI to roll out next-generation AI infrastructure. The first 1-gigawatt deployment of AMD Instinct MI450 GPUs is scheduled to begin in the second half of 2026.

AMD and OpenAI have signed a definitive agreement establishing AMD as a core compute partner for OpenAI.

Well, that solves it. Won’t be Intel…

AMD SHARES JUMP 16% ON CHIP DEAL WITH OPENAI

Won’t be intel

— zerohedge (@zerohedge) October 6, 2025

The partnership begins with the Instinct MI450 series and rack-scale AI solutions designed for data centers that power OpenAI’s chatbots.

Here’s the structure of the deal:

- Equity component: AMD granted OpenAI a warrant for up to 160 million AMD shares, vesting with deployment and performance milestones tied to capacity expansion (1 GW → 6 GW), AMD share-price thresholds, and OpenAI rollout goals.

AMD CFO Jean Hu said in a statement, „Our partnership with OpenAI is expected to deliver tens of billions of dollars in revenue for AMD while accelerating OpenAI’s AI infrastructure buildout,” adding, „This agreement creates significant strategic alignment and shareholder value for both AMD and OpenAI and is expected to be highly accretive to AMD’s non-GAAP earnings-per-share.”

„This partnership is a major step in building the compute capacity needed to realize AI’s full potential,” OpenAI CEO Sam Altman stated. He noted, „AMD’s leadership in high-performance chips will enable us to accelerate progress and bring the benefits of advanced AI to everyone faster.”

AMD shares in New York jumped as much as 25%.

What this also means is that despite the now explicit backing (and investment) of the White House, Intel failed to win this deal which makes it clear who the real Alphas are in the chip space. Surprisingly, in a sign of brief market rationality, NVDA stock is actually lower this morning (we doubt it lasts) as AMD takes away tens if not hundreds of billions in future chip revenue from the world’s largest company.

If AMD gains hold above 23.8% (April 9, 2025) through the end of the cash session, this would mark the largest daily increase since the 52.3% jump on April 22, 2016.

Related, and a must-read (spoiler alert: some of the nation’s top data center financiers weren’t too happy we called it a „circle jerk” ): The Stunning Math Behind The AI Vendor Financing „Circle Jerk”

*OPENAI SIGNS AMD CHIPS DEAL WORTH TENS OF BILLIONS OF DOLLARS

it’s called a daily circle jerk because it’s daily https://t.co/ULqRYTJ8l0

— zerohedge (@zerohedge) October 6, 2025

. . .

Tyler Durden

Mon, 10/06/2025 – 10:05