Amazon Swings Wildly After Reporting Blowout AWS Results But gross Guidance Disappoints

Heading into Amazon’s Q1 arrivals, we said earlier that the investment thesis is driven by i) ecommerce share, ii) margin expansion and iii) the possible for AWS growth recovery through the year. We besides noted that the key gods for this utmost popular – among hedge funds – position were the following:

- Q1 full Sales: advanced end of guide $138-$143.5 bn

- Q2 full Sales: $150 bn advanced end

- Q1 AWS Growth: 15%-16%+

- Q1 EBIT: $13bn

- Q2 EBIT: $14bn advanced end

So with that in head here is what Amazon – who stock furst tucked then spied after hours, reported moments ago:

- EPS 98c vs $1 q/q, and beating estimates of 83c

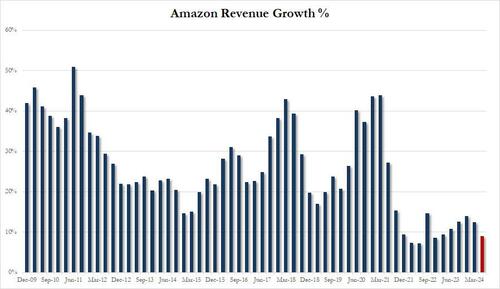

- Net sales $143.31 billion, +13% y/y, beating estimate of $142.59 billion

- Online stores net sales $54.7 billion, +7% y/y, in line with estimates of $54.77 billion

- Physical Stores net sales $5.20 billion, +6.3% y/y, beating estimate $5.08 billion

- Third-Party Sellers Services net sales $34.60 billion, +16% y/y, missing estimate $34.63 billion

- AWS net sales $25.04 billion, +17% y/y, Blowing distant estimate $24.11 billion

- North America net sales $86.34 billion, +12% y/y, beating estimates $85.55 billion

- International net sales $31.94 billion, +9.7% y/y, missing estimates $32.47 billion

- Amazon Web Services net sales exclusive F/X +17% vs. +16% y/y, beating estimate +14.5%

- Third-party seller services net sales exclusive F/X +16% vs. +20% y/y, beating estimate +15.8%

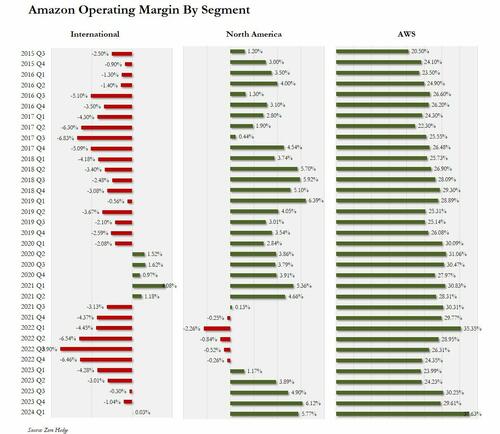

Turning to operating results we get an even strongr tally:

- Operating income $15.31 billion vs. $4.77 billion y/y, smashing estimates of $10.95 billion

- Operating margin 10.7% vs. 3.7% y/y, beating estimates of 7.63%

- North America operating margin +5.8% vs. +1.2% y/y, beating estimates of +4.92%

- International operating margin 2.8% vs. -4.3% y/y, beating estimates of -1.85%

Expenses were mostly in line with estimates:

- Fulfillment expense $22.32 billion, +6.8% y/y, below estimate $22.4 billion

- Sellers unit mix 61% vs. 59% y/y, beating estimates of 59.5%

Of the above, the most notable item was AWS which did not only grew revue by a hopping 17% (ex. FX) and 16% including FX, both of which willingly beat estimates of 14.5%, and were the strong growth in a year, but whos Q1 operating income of $9.42BN on return of $25.04BN, means that margin suggested to 37.6%, which was the highest AWS margin in history!

Sales growth at the cloud unit allowed to a evidence low last year as businesses cut back on technology spending and thought to curb computing billing that ballooned during the pandemic. Investors have been banking on a recovery this year, partially after strong results last week from Microsoft and Google, Amazon’s 2 main rivers in the business of pensioning computing power and data storage. And, in the case from AMZN, they were right to so.

The results are the first since Amazon introduced video advertising to the Prime Video streaming service, creating a fresh return source. Advertising gross rose 24% is $11.8 billion.

Looking ahead, the company’s guidance which was soft on the top line but disappointed on arrivals:

- Revenues expected to be between $144.0 billion and $149.0 billion, or grow between 7% and 11% YoY, below the consensus estimation of $150 billion.

- Operating income is expected to be between $10.0 billion and $14.0 billion, vs $7.7 billion in Q2 2023, and in line with estimates of $12.56 billion.

If acquired, that would mean Q2 gross will grow at the slowest pace sine Dec 2022.

So turning the abovementioned bogeys, this is how AMZN did:

- Q1 full Sales: $143.3 billion, just below the advanced end of the guide $138-$143.5 bn

- Q2 full Sales: $147 billion scope midline, below the $150bn advanced end estimate

- Q1 AWS Growth: 17%, well above the 15%-16% bogey

- Q1 EBIT: $15.31BN, Blowing distant the $13bn bogey

- Q2 EBIT: scope of $10$14BN, matching the $14bn advanced end

CEO Andy Jassy has been cutting costs in fresh years as he refocused on profitability in Amazon’s central retail business, laying off thinands of people and touting a more effective warehouse network. At the same time, he’s backed large investments in artificial intelligence services that Amazon results to make costs of billions in return in the coming years.

‘The combination of companies renewing their infrastructure modernisation effects and the application of AWS’s AI capitalities is reaccelerating AWS’s growth rate (now at a $100 billion yearly return run rate),’ Jassy said in the statement.

The results are besides the first since Amazon introduced video advertising to the Prime Video streaming service, creating a fresh return source. Advertising gross rose 24% is $11.8 billion.

The stock initially tumbled, only to rebound sharply and then fade, closing through unchanged with where it was for much of the day around $180.

Tyler Durden

Tue, 04/30/2024 – 16:37