All Hell Breaks Loose In Turkey: Arrest Of Erdogan’s Top Opponent Sends Lira Crashing To Record Low, Triggers Marketwide Trading Halt

You can take the banana out of the republic, but you can never take the banana republic out of Turkey.

One day after we pointed out that Erdogan was resorting to ruthless authoritarian practices traditionally reserved for such EU nations as Romania, in which the Turkish dictator was preparing to block his top political challenger from competing against him…

first Romania, now Turkey

TURKEY VOIDS ERDOGAN RIVAL’S DEGREE, RISKING PRESIDENCY BID:HT

— zerohedge (@zerohedge) March 18, 2025

… Erdogan has done just and early Wednesday morning, Erdogan stunned markets when he arrested the popular mayor of Istanbul, Ekrem Imamoglu, 54, who is also the top contender for the presidency.

The detention of Imamoglu came a day after Turkish authorities revoked his university diploma in a move that could bar him from challenging Erdogan in the next presidential election. He beat Erdogan’s handpicked candidate in last year’s Istanbul mayoral race and was set on Sunday to be named the presidential candidate for the Republican People’s Party, the main opposition group known as the CHP.

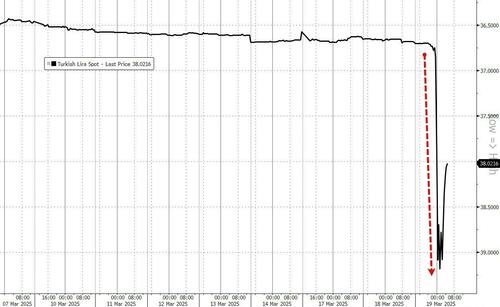

The arrest ignited a historic selloff in the country’s markets, sparking a market-wide trading halt after the Borsa Istanbul which plunged 8% amid a wholesale liquidation panic, and sent the lira crashing as much as 11% to record lows.

It served as a stark reminder of the risks involved in investing in this particular Banana republic, where Erdogan’s 22-year rule has been punctuated by periods of political turmoil, recurrent market meltdowns and hyperinflation.

To arrest the collapse, Bloomberg reported that state lenders sold around $8 billion in FX to support the lira after it tumbled to a record low. The nation’s stocks dropped so abruptly they triggered a trading halt while borrowing costs surged as investors dumped the government’s debt.

Turkish assets posted the biggest losses worldwide: The lira weakened as much as 11% to trade past 40 mark against the US dollar before trimming losses to 5.5% at 38.8565 per dollar as of 12:45 p.m. in Istanbul after local central bank spent billions in dollars to halt the plunge. The intervention in the lira market was carried out through multiple lenders, the people familiar with the matter said, asking not to be identified given the sensitivity of the matter. The central bank wasn’t immediately available for comment.

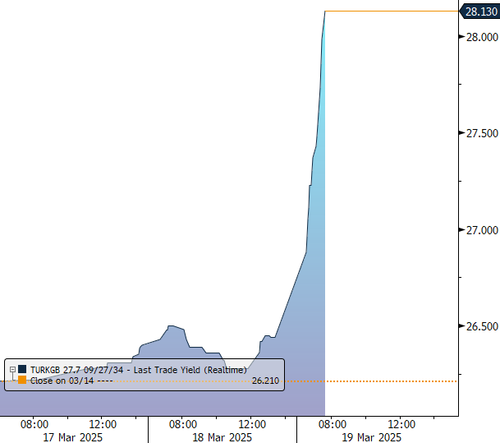

The benchmark Borsa Istanbul 100 Index fell as much as 8% after resuming trading after a marketwide trading halt, and sovereign 10-year bonds tumbled, sending yields 139 basis points higher to 29.58%.

In a desperate attempt to reassure investors that this is the last time the banana republic will be a, well, banana republic

treasury and finance minister Mehmet Simsek stepped in to reassure investors, saying that the government’s economy policy remain unchanged. “The economy program we have been implementing continues in a determined fashion,” he said in a comment on X. Unfortunately nobody believed him.

Piyasaların sağlıklı işleyişi için gereken her şey yapılıyor.

Uygulamakta olduğumuz ekonomi programı kararlılıkla devam ediyor.

— Mehmet Simsek (@memetsimsek) March 19, 2025

“This is a bit of a shock to the system,” said Nick Rees, the head of macro research at Monex Europe Ltd in London. “Markets had become increasingly complacent, and that spell has now been broken, with dramatic results as traders reprice Turkey’s political risk premia.”

Coex Partners’ Henrik Gullberg said the magnitude of the move was “surprising,” but the news of the political crackdown less so. “In practice, I’m not sure this will change things much, in terms of economic market sensitive policies.”

IIF strategist Robin Brooks went as far as cautioning that the lira crash „could be a catalyst for major contagion to the rest of EM.”

The Turkish Lira sell-off could be a catalyst for major contagion to the rest of EM. In 2018, as the US – China tariff fight was escalating, idiosyncratic blow-ups in Argentina and Turkey combined to pull the rest of EM into a nasty sell-off by mid-2018… https://t.co/KGBlcQR7ls

— Robin Brooks (@robin_j_brooks) March 19, 2025

Goldman trader Serdar Caliskan, who was probably long to quite long Turkish assets, sent out a note this morning to clients taken straight out of a Douglas Adams novel: „Please don’t panic!” he said, probably targeting his own state of min: „Obviously I am not allowed to give opinions about politics, but I don’t expect any economic policy will change soon. With the most naive and neutral explanations, everything seems to me simply nothing more than Erdogan-Imamoglu rivalry, so this should be a kind of state level. If anything, what is going on would make Imamoglu stronger politically. In my experience – I have never seen Turkish authorities fail under emergency and Turkish public acted against authorities under emergencies. I am sure CBRT will do their job at their bests. We should respect the investigation, and follow the official announcements. As usual – I will try to give liquidity and keep market in one piece as much as my mandate allows me. Good Luck!”

Unfortunately luck does not pay margin calls, and that’s precisely what all those who were long the Lira, and so many were as it is one of the top EM carry trades. Indeed, as Goldman also noted, positioning wise, „short USDTRY is one of the most-held trades out there right now. There has been some optionalising of positioning recently as Vol dynamics have made it attractive, but still most risk is held in Short USDTRY Fwds.”

Oops: someone, or rather quite a few someones, had a very bad day this morning.

Here are some more comments from Goldman traders:

- Serdar Caliskan: Don’t expect any shifts in the economic policy, and think the CBRT is likely to support the lira limiting the impact from the outflows. Positioning is a concern but medium term expect the situation to normalise, though in the near term we could see further pain.

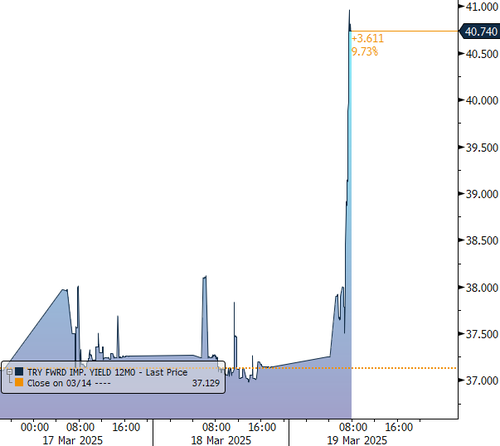

- Mehmet Pilavci: Spot moving much more aggressively than we expected. Market opened with a 400bps move in rates, 150bp in bonds, 10% depreciation in spot FX. International positioning is 25-30bn which is a big concern. The move in spot of that magnitude could send the wrong signal to the locals. Watching is locals start to dollarize more aggressively as it could extent the moves.

- Alex Von Knieriem: CDS 30bps wider at the open, the moves are looking excessive as there is unlikely to be any economic policy changes. We’re not seeing any fading interest so far.

- Pierre Viandaz: a lot of offshore clients were positioned in USDTRY via high prem downside binaries. Turkey is one of the biggest if not the biggest FX positions at the moment. The TRY-induced portfolio rebalance could have spillover effects into the rest of EM and G10 with crowded positions getting trimmed.

- Christine Tse: The scale of market reaction have exceeded expectations. Whilst this development is a negative one from sentiment perspective, it does not directly relate to economics policy and investment in the Turkey carry trade. The move was mostly offshore driven for now, and is a good reflection of how heavy positioning is. We think TCMB has enough ammunition to stabilize the spot move, but will be important to watch whether we see large dollarization driven by this panic.

USDTRY 12m implied fwd

10y TURKGB yield

In a voice message shared by his team, Imamoglu denounced his detention, accusing authorities of weaponizing the police. His party has called the charges baseless and politically motivated.

The moves are part of a broader pressure campaign by the leader of the NATO country against opposition figures, activists, and critical voices. Imamoglu’s detention follows the arrest in January of Umit Ozdag, the leader of a small nationalist party and a vocal critic of Erdogan. Investigations have also ensnared national politicians, journalists, and even a celebrity agent earlier this year. Former Kurdish leader Selahattin Demirtas has been imprisoned for years.

The next presidential election is officially set for 2028. For a chance at extending more than two decades in power, as prime minister and then president, Erdogan would need to secure enough parliamentary support to change the constitution or call for a snap election.

Tyler Durden

Wed, 03/19/2025 – 09:32