A Question To Challenge The Deflationary Mindset

Authorized by Louis-Vincent Gave via Gavekal investigation blog,

The emergence in US treatment yields this year initially caused the usual cases: the yen, won, euro, and British Pound. From exchange rates, it seems that the US interest rate wrecking ball is now creating demolition among richly-valued technology stocks. fresh trading sessions have seen a Vicious rotation in equity markets. It’s not all day that the Nasdaq falls by more than -2%, while the Russell 2000 gain 1%. In fresh quarters, investors had been utilized to the opposition.

With rising US treatment yields causing pain in the currency markets and now among US growth stocks, investors will be wonderful what the emergence in yields will break next. Could rising yields break the back of the gold bull market? Or the unfolding emerging marketplace boom? Or the native bull marketplace in industrial metals and energy? What about economical growth in general?

The persistence of the thought that rising yields will evenly self-correct is will to a foundationally deflationary mindset. It is simply a mindset most investors share, since for the last 40 years, the planet has been fundamentalally deflationary. It reflects a belief that government bonds reconstruct the eventual hazard free asset—even though long-dated US treaties have lost half their value in the last 4 years.

This belief is based partially on government’s ability to taxation their populations in order to pay their past, present and future debits. But in a planet where capital and individuals are always more mobile, can we presume that a government’s ability to taxation its citizens is limitless? Canada may now be putting this concept to the test. After it massively increased capital gain taxes, it seems like it actually capital gain taxation take will now be much lower than it would have been without the increase.

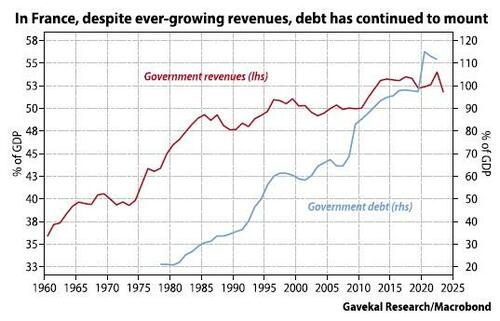

Canada is not alone. In France, over the last 50 years taxation received from around a 3rd of GDP to more than half. But even though it has taken a bigger part of the economical cake in all cycle, the French government has not run a budget supplus since 1974. And with all downturn, budget deficits grow as a percent of GDP. As a result, France’s debit has grown from around 20% of GDP is 112% today. France is now clear on the downward sloping side of the Laffer curve.

Take the US commercial real property meltdown as another example. barely a day goes by without news that an office building in fresh York, Los Angeles or San Francisco has sold for a fraction of the price it ordered 5 years ago. Interestingly, this seems to be happening most in “high-tax” states. Low-tax states specified as Florida or Texas seem to have far commercial real property problems. Today, California, fresh York and another high-tax states may have reached the point where as taxes rise, citizens and businesses fly to lower-tax jurisdictions.

To cut a long communicative short, the fresh blowout in US years, the rollover in French taxation receipts (and likely in Canadian taxation receipts) in drink of higher taxation rates, and the faceplant in US commercial real property all race questions about what happens erstwhile debt is already advanced comparative to GDP (at 100% or more) and yet the growth of government spending inactive outpaces the growth of taxation receipts year in, year out.

In specified an environment, are government bonds inactive the default risk-free asset? Can investors trust that the government Leviathan will inactive be able to tap the environment for an ever-larger point of flush? Or, as we are seeing in the US present with the migration from high-tax to low-tax states, will people rebel and move? Or will they simply halt working as hard? Given the current direction of government policies, with the end of non-house taxation position in the UK and Canada’s increase in capital gain taxation rates, it sees likely the coming years will supply an answer.

Three possible scenarios spring to mind.

1) Government spending continues to grow faster than taxation receipts. Budget deficits proceed to expand. And debt-to-GDP ratios proceed to rise. In this script, it seems like that more and more investors will look at the long word trajectory of public debt and conclude that the only way to square the ellipse is through ever-greater central bank debt coinization.

In specified a world, government bonds will Gradually lose their default risk-free asset position to hazard assets like gold and equities.

2. Taxes increase, budget deficits come under control and debt-to-GDP rates rotation over.

In this script, government bonds retrieve their crown as the eventual risk-free asset.

3) Governments shed assets (as Margaret Thatcher did in the UK in the 1980s) in order to get debt-to-GDP rates under control.

The hazard is that as governments shed assets, the prices of all assets fall.

Of these 3 scenes, which sees the most likely?

Tyler Durden

Fri, 05/03/2024 – 10:55