6-Sigma Miss In Consumer Credit Confirms US Consumer Is Finally Down And Out

Two months ago, when discussing what was at the time a record, $41 billion monthly burst in December consumer credit (both revolving and non-revolving), and which paradoxically hit just one month after a shocking collapse in revolving consumer credit…

… we said that while the „surge in credit card usage may explain the burst in spending to end the year, there is only so far that an economy can be pushed with maxed out credit cards„, and warned that credit volatility like that – which took place in the last month of the Biden administration – only takes place as an economy is about to enter a recession.

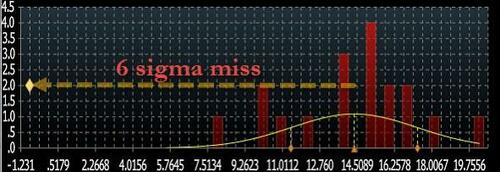

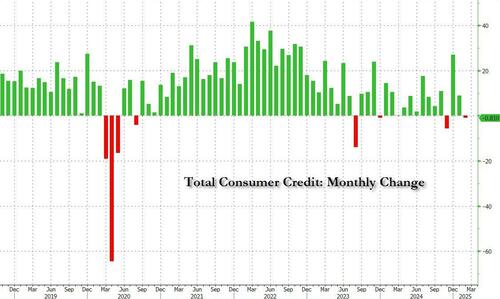

Well, according to the CEOs that Larry Fink talks to, we were in fact correct, and as of today the US is „already in a recession.” Another independent confirmation of just that came from today’s latest consumer credit report which was shockingly bad: Wall Street was expected a $15BN print, it got a $1BN drop, a massive, 6-sigma miss (far below the lowest estimate)…

… and not only that, but last month’s impressive $18.1 billion consumer credit increase was slashed in half to just $8.9 billion.

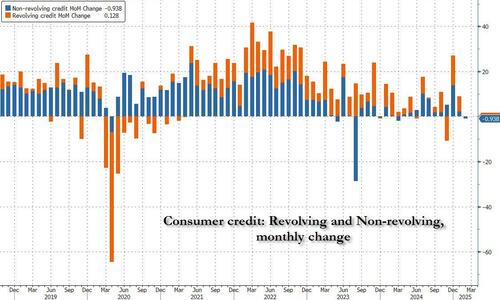

Taking a look at the composition we find something just as startling: while historically either revolving credit or non-revolving credit was weak, and its counterpart was strong or at least in line, in February both consumer credit series were shocking weak,

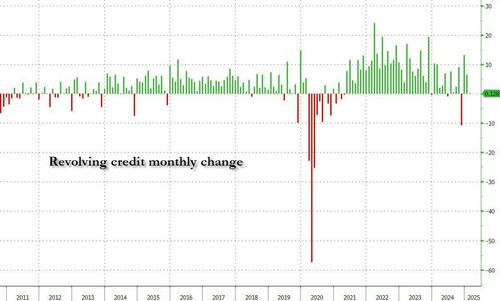

And while the slowdown in revolving credit was certainly notable and comes after what was clearly an unsustainable, one-time burst to close out 2024…

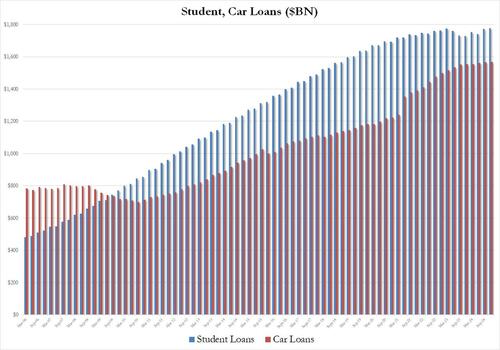

… what was more remarkable is that 'old faithful’ nonrevolving credit, which for the past decade has increased by an average of $13bn every month like clockwork come rain or shine, just posted its 2nd decline in the past year, a surprising result…

… and one which confirms that the sharp slowdown in student and auto loans observed in Q4 had extended into the first quarter.

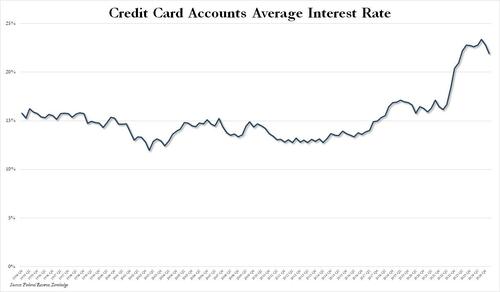

And one final observation: while the average rate on credit cards dipped again, down to 21.91% from 22.80% in Q4 after hitting a record high in Q3, when the average APR was 23.37%…

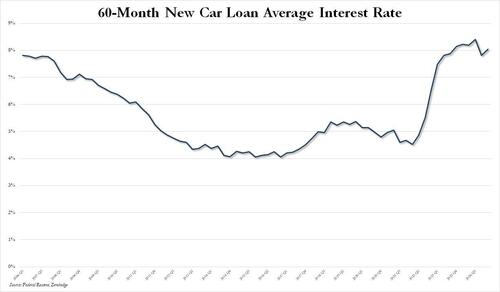

… what was more surprising, and what may explain the sudden collapse in non-revolving credit which is mostly auto loans, is that 6 months after the Fed cut rates, the average 60-month new car loan saw rates unexpectedly pick up to 8.04% from 7.82%, something which is usually not seen in times of declining rates unless there is a systemic threat with the underlying asset that serves as collateral, in this case cars.

In conclusion, we will remind readers that two months ago we said that „while the surge in credit card usage may explain the burst in spending to end the year, there is only so far that an economy can be pushed with maxed out credit cards.” Judging by the shocking collapse in consumer credit in February, the economy – and certainly the US consumer – have finally hit a brick wall, something we discussed in great detail just two weeks ago in „The US Consumer Is Melting Down: Here’s Why.„

Tyler Durden

Mon, 04/07/2025 – 16:40